Advertisemen

Here we are again, albeit a month later than usual (apologies), time to pronounce my Top Ten Sustainability Reports for 2016. I have been picking Top Tens now for several years... 2010, 2014 and 2015. These Top Ten posts are always the most popular posts of the year and get thousands and thousands of views. Every year I say that selecting my Top Ten is the hardest thing I do on the CSR Reporting Blog and every year I am right. I am always soooooo tempted to increase the number to more than 10. And this year, I broke.

I decided to go for ?? 15 ?? reports this year.

As I did last year, I will acknowledge once again a small group of favorite reporters and its very tempting to include them year after year ... great, consistently high quality reporters such as Impahla, Telekom Austria, Larsen and Toubro, Westpac Australia, BT, Tiffany &Co, Marks and Spencer, Kingfisher, Hang Lung Properties and several others. I know when they publish that their report is going to be informative, professional, useful and good quality. But if I included these reporters every year, I wouldn't have room for any others. The entire purpose of the Top Ten 15 is to spread awareness and recognition beyond the reporters that already have a good share of attention. I have not included reporters that have been included in past lists.

My Top Reports selection is always based on reports that cross my radar throughout the year, not a scientific or strict methodical evaluation of report quality. I try to select a cross-section of companies, sectors and countries, rather than the big names in reporting that generally pick up reporting awards around the world. I focus on reports by corporations / businesses, not public agencies or non-profits or trade associations - although there are some really great innovative and important reports coming out of these sectors. Of course, I exclude reports of clients of my firm Beyond Business which we have helped prepare.

As I have done for the past few years, I loosely use the AIM MODEL as I consider the reports that I find worthy of mention. Each report adds value in its own way, and each report is evidence of progress. Therefore, in mentioning a mere 15 reports of the thousands that were published in 2016, I continue to do reporting somewhat of an injustice. On the other hand, highlighting 15 reports and their unique elements may provide insights and inspiration for new, or potentially better, reporters. In any event, this is always a post I find both challenging and fun all at the same time.

Here is a quick reminder of my AIM MODEL:

Authenticity: I look for whether the company has reported in an honest way, using stakeholder voices to supplement performance data. Authenticity for me includes balance, accuracy and completeness. I look for targets and progress against stated targets.

Materiality: I look for whether the company has clearly defined the most important issues for the company and its stakeholders and described the way in which those issues have been identified and prioritized. Reporting materiality should also include a certain amount of contextual information which can assist us in understanding the issues and why they are material.

Impacts: I look for whether the company identified impacts rather than just presenting a shopping list of activities. This means discussing the outcomes of what was achieved. The outcomes are the achievements (impacts), not the activities. This is by far the most difficult thing for companies to address and very few do it well. By the way, even the Top 15 reports have opportunity for improvement. So don't expect me to be exclusively gushing. That's not in my nature.

In alpha order by company name, here is my Top 15 pick for 2016:

?? Amtrak 2015 Sustainability Report (USA) ?

?? Baoviet Holdings Sustainability Report 2015 (Vietnam)

?? Bursagaz Sustainability and Annual Report 2015 (Turkey)

?? CLP Group 2015 Sustainability Report (China)

?? Digi.com 2015 Sustainability Report (Malaysia)

??Drummond Ltd 2015 Sustainability Report (Colombia)

?? Lion FY15 Sustainability Report (Australia, New Zealand)

?? Malta International Airport Sustainability Report 2015 (Malta)

?? Mindtree Sustainability Report 2015-16 (India)

?? Sega Sammy Group CSR Report 2016 (Japan)

?? Siloso Beach Resort Sustainability Report 2015 (Sentosa, Singapore)

?? VanDrie Group Annual CSR Report 2015 (Netherlands)

??Vi�a Concha y Toro Sustainability Report 2015 (Chile)

?? Wm Morrison Supermarkets plc Corporate Responsibility Review 2015/16 (UK)

?? Zain Sustainability Report 2015 (Kuwait)

The National Railroad Passenger Corporation (Amtrak) operates a network of intercity long-distance, shorter commuting-distance and high-speed passenger rail services spanning 46 states. Nearly 30.9 million riders traveled on Amtrak in FY15, generating more than $2.1 billion in ticket revenue. Amtrak is a federally chartered corporation, operating as a for-profit company, with the federal government as a majority stakeholder. Amtrak has more than 20,000 employees.

Amtrak's report is cleanly designed, no clutter, easy to read and materially focused. The 2015 materiality assessment is presented as a list (I always prefer this to a matrix) with 11 issues that are company specific and not simply a selection from GRI's pre-prepared list. This demonstrates focused thinking about materiality, even though Amtrak does not appear to have consulted stakeholders specifically in the preparation of this list.

However, Amtrak states: "We plan to conduct external stakeholder interviews in the future to make our materiality assessment and sustainability reporting processes as comprehensive as possible." I like this. It shows that the company is moving forward with what they have and plans to improve and validate. Better than sitting on the sidelines until it's all bottomed out.

Separately, Amtrak lists stakeholder groups, key methods of engagement and areas of stakeholder interest in a table which also links to a case study on engagement with each stakeholder group.

Separately, Amtrak lists stakeholder groups, key methods of engagement and areas of stakeholder interest in a table which also links to a case study on engagement with each stakeholder group.

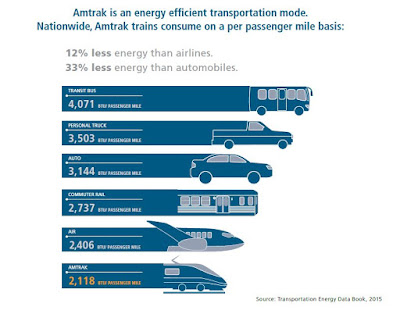

An early section of the report describes the economic and social benefits of rail travel. This is a nice way to position to social value that Amtrak rail services bring across the U.S. and a good backdrop to understanding Amtrak's impacts and material focus. Later, an environmental benefits are also described.

The report is structured in chapters which align with the material topics: Safety and Security; Customer Focus; Financial Excellence; Environment; Human Capital and Planning for the Future. All 11 material issues find a home in these chapters.

The Amtrak report contains several case studies about different aspects of the operations presented throughout the report. Each gives a glimpse of the complexity of rail operations, such as the extensive preparations that were required before the papal visit in 2015.

Amtrak applies the GRI framework well, and links all its material issues to GRI material aspects. I always find this helpful - simply posting a materiality matrix and a GRI Content index without linking the two makes it hard for readers to track how what's important is managed and measured. Often, that's because there is no connection. By making this explicit in the GRI Content Index, as Amtrak has done, we can not only easily find what fits with what, we know that the company has adopted a structured and integrated approach to materiality management.

Amtrak is also upfront about where it has not been able to comply with GRI disclosure requirements.

In summary, Amtrak's report fits the AIM model well. It's an impressive report, professionally done.

~~~~~~~~~~~~~~~~~~~~~~~~??????~~~~~~~~~~~~~~~~~~~

Vietnam, GRI G4 Core, 4th report,142 pages

Baoviet was established on 15 January 1965, and is the leading financial-insurance group in Vietnam. It has been accredited as one of the top 25 enterprises in the country by the State Government. The Group is headquartered in Hanoi with more than 150 branches across 63 provinces nationwide. Baoviet was the first insurance company incorporated in Vietnam and employs 5,467 people.

It's not by chance that I came across this report. As a judge in the ASRA (Asian Sustainability Reporting Awards) again in 2016, I had the pleasure of reviewing close to 100 reports from several Asian countries across several categories. The Baoviet report stood out as one of the best, and indeed, it bagged first place as Asia's top sustainability report of the year. A well-deserved win and one that I endorsed as a member of the judging panel.

The report is beautifully presented in a tasteful design which combines compact narrative with charts, tables, infographics and imagery that are pleasing to the eye. The opening message from the Chairman is a good mix of business context and the relevance of sustainable development, and reads Authentically. This is followed by a presentation of sustainability highlights from 2015, either as a taste of more to come in the body of the report, or as a quick overview for those who do not plan to cover all 142 pages.

Also, Baoviet links to the Sustainable Development Goals, one of the earlier-adopter reports to make the connection and start to align with this global agenda. A set of specific goals and initiatives for implementation in 2016 support six SDGs.

Baoviet's Materiality focus is presented in a matrix, making the connection between material issues and the location of relevant disclosures in the report.

Baoviet's Materiality focus is presented in a matrix, making the connection between material issues and the location of relevant disclosures in the report.

Chapters start with a Disclosure on Management Approach and GRI disclosure labels help locate relevant performance indicators and discussion of Impacts. Presentation of charts and graphs is simple but effective.

AIM. Check.

AIM. Check.

~~~~~~~~~~~~~~~~~~??????~~~~~~~~~~~~~

Bursagaz Sustainability and Annual Report 2015

Turkey, GRI G4 comprehensive option, 2nd report, 172 pages

References SDG in GRI Content Index (SDG Mapping)

References SDG in GRI Content Index (SDG Mapping)

Bursagaz was established as a subsidiary of state-owned company and started to sell natural gas in 1992, before being privatized in 2004. In 2008, Bursagaz was acquired by EWE Turkey Holding. Bursagaz has 884,000 total subscribers and is Turkey's second largest natural gas distributor, employing 259 people.

I love the concept and design of this report. You can't help being attracted to the bold and beautiful, creative and uniquely special design of this report, which gets more appealing every time you take a look, and then draws you in to the report content. Themed "The Essence of Life", the report takes us through a young girl's journey in "The Story of Yesterday, Today and Tomorrow" - a journey prompted by the fact that she knows that "Everyone needs a future in which they attach more importance to one another." Throughout the report, the little girl goes on her journey, stopping to meet an amazing array of exquisitely-designed members of the animal kingdom, each of whom has an inspirational message for the little girl, in its own language. It's a story of the wonders of nature and how we can be inspired by nature .. the very essence of life indeed.

Alongside the spellbinding design, the substance of this report is also highly respectable. The focus is clear with both a Materiality Matrix and targets aligned with material topics.

Performance against 2015 goals is noted, and 2016 goals are stated. This is one of the few material approaches I know that includes Stakeholder Engagement as a material topic in its own right and has specific and measurable 2016 targets relating to this aspect. Later in the report, Bursagaz provides narrative relating to stakeholder engagement, listing all stakeholders by name in order of priority, the nature of the relationship with them and the category (social or economic) of their prime interest.

|

| A selection from the Bursagaz 2016 goals page |

Throughout the report, Bursagaz is earnestly, almost fanatically, transparent, providing details of policies, decisions, processes and changes for every topic. It's a little too much to read, but it's evidence of a genuine desire to achieve strong transparency. If you stay with it you realize that it's a feat of disclosure. Data is presented well in clear tables and charts throughout the report. Data labels to the G4 Content Index are included and my spot check brought me to the disclosures I sought from the Index.

Even my top pick reports have opportunities for improvement. I believe Bursagaz has an opportunity to continue its journey by maturing its communication in future years. I would recommend including more context in describing Bursagaz key impact areas, indication of the depth of stakeholder engagement with quoted voices and contributions in the report and a case study or two demonstrating examples of practice. The report should also be much shorter - this one has early onset TMI disease (TMI=Too Much Information). The narrative is trees not forest, and the English translation is poor. An extra investment in tightening up the language and an English QC check would improve the Anglophone experience. Here's a little error that made me smile:

The English in this report is a bit of a neramiss ??

However, it's definitely a Top 15. Bursagaz's sheer investment in creating this report is a testimony to the commitment and passion of the company to make a sustainable contribution and be transparent to stakeholders. The imagination and creativity of the storybook, aligning sustainability with nature at its most spectacular and telling the story of the essence of life, present sustainability in a positive light and inspire optimism. It seems Authentic, it's guided by Material and it's clear about its Impacts.

CLP Holdings Limited is a publicly held company since 1901, one of the largest investor-operators of power assets in the Asia-Pacific region, with businesses across Hong Kong, Mainland China, India, Southeast Asia and Taiwan and Australia. CLP Group's business includes power generation, transmission and distribution, and electricity and gas retail activities, employing over 7,300 people, and serving over five million customer accounts.

CLP provides a detailed review of extensive stakeholder engagement processes in the reporting year, walking us through the stakeholder engagement framework, key stakeholder groups, concerns raised by each group and CLP responses in the reporting year. This is one of the most detailed descriptions of such processes that I have seen. It culminates with a description of the materiality process and list of issues.

There are many more positive and impressive elements of the report, too numerous to mention in this very long post, such as the alignment with the Sustainable Development Goals, the presentation of a climate vision with targets through to 2050, a whole section about business context, megatrends affecting sustainability, risks and opportunities and much more. In each core section of the report, the material aspects are identified and disclosures are presented accordingly. The PDF is hyperlinked so navigation is super easy.

While many would consider such a long report to be a bit too much, and there is a definite trend towards shorter reports today, the CLP 2015 report is a bible among reports and it delivers its content so clearly, attractively and comprehensively that it's definitely deserving of recognition. AIM. Check.

Oh, and this is one of the nicest ways to solicit feedback:

~~~~~~~~~~~~~~~~~~??????~~~~~~~~~~~~~

China, GRI G4 Core, 14th report, 238 pages

CLP Holdings Limited is a publicly held company since 1901, one of the largest investor-operators of power assets in the Asia-Pacific region, with businesses across Hong Kong, Mainland China, India, Southeast Asia and Taiwan and Australia. CLP Group's business includes power generation, transmission and distribution, and electricity and gas retail activities, employing over 7,300 people, and serving over five million customer accounts.

This is by far the longest report in the 2016 selection, dwarfing other reports with a whopping 238 fully populated pages. CLP clearly gets through a lot of stuff in a year and has much to report. And it does so professionally and aesthetically. The report is laid out tastefully, with photo imagery, infographics and color coding by section to make this report a true work of art.

The report opens with a joint Chairman and CEO message which provides a useful overview of business context as well as highlighting some sustainability imperatives including a science-based target to reduce carbon intensity by 75% to 2050.

CLP provides a detailed review of extensive stakeholder engagement processes in the reporting year, walking us through the stakeholder engagement framework, key stakeholder groups, concerns raised by each group and CLP responses in the reporting year. This is one of the most detailed descriptions of such processes that I have seen. It culminates with a description of the materiality process and list of issues.

There are many more positive and impressive elements of the report, too numerous to mention in this very long post, such as the alignment with the Sustainable Development Goals, the presentation of a climate vision with targets through to 2050, a whole section about business context, megatrends affecting sustainability, risks and opportunities and much more. In each core section of the report, the material aspects are identified and disclosures are presented accordingly. The PDF is hyperlinked so navigation is super easy.

While many would consider such a long report to be a bit too much, and there is a definite trend towards shorter reports today, the CLP 2015 report is a bible among reports and it delivers its content so clearly, attractively and comprehensively that it's definitely deserving of recognition. AIM. Check.

Oh, and this is one of the nicest ways to solicit feedback:

~~~~~~~~~~~~~??????~~~~~~~~~~

Malaysia, GRI G4 Core option, 5th report, 30 pages

DiGi.Com Berhad is listed on Bursa Malaysia and is part of the Telenor Group, a global telecommunications provider. DiGi provides mobile voice, Internet and digital services to 11 million customers in Malaysia with around 2,000 employees.

This is a report that immediately strikes you as clean, orderly, well-planned and well-presented. It probably takes the prize for the highest number of icons across 30 pages. It's a pleasure to read this kind of report - it's simplicity belies the investment that I expect went into its generation. The structure lacks clutter.

I like the CEO statement. It's plain talk and includes reference to the challenge of growing the business while limiting environmental impacts. "During the year we accelerated rollout of our LTE network, doubling our footprint to serve growing demand for quality high-speed internet on our widest 4G LTE network. While this brought about higher energy intensity, the higher cost per kilowatt is temporary and we expect sequential improvements in our energy intensity over the years as we gain better leverage from having more Malaysians benefiting from being connected to our high speed LTE network on the go." It's sounds authentic and upfront. DiGi.com is not the only business to face this dilemma.

Digi.com's materiality matrix is set against the framework of Telenor parent company's materiality priorities, tweaked, it seems, to reflect local relevance. While the process of developing the local matrix is not disclosed in any detail, Digi.com includes a section called "Meet the Stakeholders" where each stakeholder group is presented, engagement channels described, issues raised and approaches described to address issues.

The body of the report provides updates on performance, covering the material topics in turn. It's short, focused and well constructed. In some cases, a lack of outcome weakens this disclosure - I always look to understand what kind of a difference a company made, not just what it did - but in other cases, a sense of outcome is provided.

And just so there is no confusion, Digi.Com makes the end of its disclosure quite clear:

AIM: well done.

~~~~~~~~~~~~??????~~~~~~~~

Colombia, GRI G4 core, 5th report 164 pages

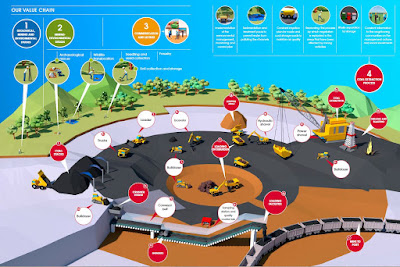

Drummond Ltd. is a mining company that operates only in Colombia, property of Drummond International LLC, a company based in Alabama, United States. Drummond's operations include the exploration, production, transportation and exportation of steam and coal. much of which is exported around the world. Drummond employs almost 5,000 people.

This is a creatively designed report with attention to detail. The use of color is extensive (a frequent characteristic of South American reports). Just take a look at Drummond's value chain and other visuals:

Aside from the color and creative graphics, this report provides a comprehensive disclosure structured in three main sections: economic, social and environmental. First, Drummond presents a materiality process, indicating the key elements and sources informing the selection and prioritization of material issues, followed by the matrix, followed by a more detailed explanation of each issue and its alignment to GRI aspects and corresponding performance indicators. This is a positive attempt to describe the materiality process - and while the actual prioritization of issues is still not entirely transparent - it's more revealing than vague descriptors we find in many reports.

(As an aside, though, the color coding of issues makes it rather difficult to decipher which is which. A number or symbols system might be a better approach.)

Drummond provides goals and targets for 2016, and in many cases, for medium and/or longer term in each section of the report. Also in each section is a description of Impacts with quantitative qualifiers in some cases.

~~~~~~~~~~??????~~~~~~~

Australia, GRI G4 Core option, 7th Report, 49 pages (plus separate GRI Index)

Lion is one of Australasia�s largest food and beverage companies, employing approx 6,700 people across Australia and New Zealand marketing premium brands in the dairy, juice, soy, beer, cider, fine wine, spirits, alcoholic ready-to-drinks and non-alcohol beverages categories. Lion is the leading brewer in both Australia and New Zealand, and its overall portfolio, produced across 33 sites, collectively generates revenues of around $5 billion each year.

Lion's reports are always beautiful, creative and easy to read. Despite a rather wishy-washy any-year leadership statement, the report starts off with a clear business strategy with embedded sustainability, Lion presents strategic quantitative targets to FY18 and progress to date.

The material topics and targets are company and sector specific - not the generic all-company type of materiality matrices that we see in so many reports. However, it would be nice to see a clearer link between strategy and materiality and performance targets.

The report is structured in line with these material topics - each report section representing a material sub-set. Despite this report claiming to be in accordance with G4, there are some gaps. Lion reports just 10 Performance Indicators, and these are spread rather thinly for the 22 "highly material" issues listed on the matrix. In some cases, the indicators are not reported in line with G4 requirements. I would recommend reviewing the material alignment of this report both with strategy and performance progress and tightening up disclosures to meet stated standards.

On the other hand, what really stands out about this report, and the primary reason for its inclusion in the Top 15 (in addition to the fabulous presentation) is the outside-in focus. The predominant content of this report refers to the way Lion is helping change the industry and consumer behavior. Rather than just being a company that sells stuff, Lion presents impressive detail of a host of public policy changes and engagements that affect food regulation and support consumer benefit, describing the context and stating the Lion position and actions. A commissioned independent assessment of Lion's economic impacts provide detail of how Lion makes a contribution to economic life in Australia and New Zealand, including tax transparency. The supplier engagement section discloses ways in which Lion contributes to farmer prosperity through engagement and support with some case studies, including a nice story about how Lion supports dairy farmers through promoting the benefits of drinking milk. A few external stakeholder find their voice in this report as well.

Lion is also changing consumer behaviors through raising awareness of health and nutrition, improving the nutritional profiles of its products and engaging in several consumer awareness campaigns.

The report presents a picture of a retailer that is connected to its consumers and communities and understands their needs. I find this relevant and Authentic. In several cases, Impacts are reported, for example, shifts in behavior of 18-24 year-olds in response to Lion's Drink Wise campaign. Materiality, as mentioned, is presented as a credible set of issues for this type of business.

And another example of nicely-done graphics to round off this Lion review:

Malta International Airport (MIA) welcomes over five million passengers each year and links three continents with over 90 airports directly to Malta. Economic activity involving aviation and non-aviation enterprises contributes to more than 15,000 jobs and over 9% of Malta�s GDP. MIA has 289 employees.

MIA's first report (you know I LOVE first reports) is structured in line with the GRI G4 framework, indicator by indicator. This is a safe choice and enables disclosures to be easily located and easily verified against the framework. Reports that follow this framework tend to be technically sound but lack a little sparkle and creativity. By reporting in the order of the GRI disclosures and indicators, the report tends to flow in a way which doesn't necessarily reflect the real story of company and its predominant impacts on society. Disclosures tend to be limited to disclosure requirements, which make for a rather limited narrative. However, for Malta, for a first report, this is a respectable choice and one that the company applies meticulously.

Material issues are presented in a list rather than a matrix, and are the prescribed GRI Aspects rather than a company-specific list of issues. Stakeholder interests are presented in a table showing key channels of engagement and key interests by stakeholder group. No specific stakeholder engagement appears to have been initiated for this report.

Each of the main sections - economic, environment and social - kick off with targets for 2015 and performance. Throughout the narrative , MIA provides local context which is helpful in understanding MIA's performance and impacts. The layout is clean and tables and graphs are easy to understand.

The meticulous application of the GRI Framework is also found in an appendix to the GRI Content index where MIA describes all the bases for calculation of the metrics provided in the report. This is a useful chart. However, in other cases, it seems that MIA has responded to indicators in order to complete the GRI framework without aligning these to material priorities and providing a relevant management approach disclosure.

However, reporting is a learning curve, and I feel that, as MIA becomes more confident in its GRI reporting and deepens its understanding of the framework (now standards), the company could report more memorably in the future. In the meantime, big congrats on a first-timer and for showing that even smaller organizations can deliver very solid and meaningful sustainability reports.

The report is structured in line with these material topics - each report section representing a material sub-set. Despite this report claiming to be in accordance with G4, there are some gaps. Lion reports just 10 Performance Indicators, and these are spread rather thinly for the 22 "highly material" issues listed on the matrix. In some cases, the indicators are not reported in line with G4 requirements. I would recommend reviewing the material alignment of this report both with strategy and performance progress and tightening up disclosures to meet stated standards.

On the other hand, what really stands out about this report, and the primary reason for its inclusion in the Top 15 (in addition to the fabulous presentation) is the outside-in focus. The predominant content of this report refers to the way Lion is helping change the industry and consumer behavior. Rather than just being a company that sells stuff, Lion presents impressive detail of a host of public policy changes and engagements that affect food regulation and support consumer benefit, describing the context and stating the Lion position and actions. A commissioned independent assessment of Lion's economic impacts provide detail of how Lion makes a contribution to economic life in Australia and New Zealand, including tax transparency. The supplier engagement section discloses ways in which Lion contributes to farmer prosperity through engagement and support with some case studies, including a nice story about how Lion supports dairy farmers through promoting the benefits of drinking milk. A few external stakeholder find their voice in this report as well.

Lion is also changing consumer behaviors through raising awareness of health and nutrition, improving the nutritional profiles of its products and engaging in several consumer awareness campaigns.

The report presents a picture of a retailer that is connected to its consumers and communities and understands their needs. I find this relevant and Authentic. In several cases, Impacts are reported, for example, shifts in behavior of 18-24 year-olds in response to Lion's Drink Wise campaign. Materiality, as mentioned, is presented as a credible set of issues for this type of business.

And another example of nicely-done graphics to round off this Lion review:

~~~~~~~~??????~~~~~~~~

Malta, GRI G4 (Core), 1st report, 52 pages

MIA's first report (you know I LOVE first reports) is structured in line with the GRI G4 framework, indicator by indicator. This is a safe choice and enables disclosures to be easily located and easily verified against the framework. Reports that follow this framework tend to be technically sound but lack a little sparkle and creativity. By reporting in the order of the GRI disclosures and indicators, the report tends to flow in a way which doesn't necessarily reflect the real story of company and its predominant impacts on society. Disclosures tend to be limited to disclosure requirements, which make for a rather limited narrative. However, for Malta, for a first report, this is a respectable choice and one that the company applies meticulously.

Material issues are presented in a list rather than a matrix, and are the prescribed GRI Aspects rather than a company-specific list of issues. Stakeholder interests are presented in a table showing key channels of engagement and key interests by stakeholder group. No specific stakeholder engagement appears to have been initiated for this report.

Each of the main sections - economic, environment and social - kick off with targets for 2015 and performance. Throughout the narrative , MIA provides local context which is helpful in understanding MIA's performance and impacts. The layout is clean and tables and graphs are easy to understand.

The meticulous application of the GRI Framework is also found in an appendix to the GRI Content index where MIA describes all the bases for calculation of the metrics provided in the report. This is a useful chart. However, in other cases, it seems that MIA has responded to indicators in order to complete the GRI framework without aligning these to material priorities and providing a relevant management approach disclosure.

However, reporting is a learning curve, and I feel that, as MIA becomes more confident in its GRI reporting and deepens its understanding of the framework (now standards), the company could report more memorably in the future. In the meantime, big congrats on a first-timer and for showing that even smaller organizations can deliver very solid and meaningful sustainability reports.

~~~~~~~~~~~??????~~~~~~

Mindtree Sustainability Report 2015-16

India, GRI G4 Core, 4th report, 115 pages

Founded in 1999, Mindtree Ltd., headquartered at Bangalore, is an information technology company with a turnover of USD 715.2 million, employing more than 16,600 people in India, North America, Europe and Asia Pacific regions.

The Mindtree report is another uplifting report from the people behind "Welcome to Possible". This is a modestly toned report, describing a philosophy as well as a way of doing business. A materiality process is included and a set of goals that align with material issues.

The highlight of Mindtree's report this year is the creation of a new learning center - Mindtree Kalinga. In several pages devoted specifically to this sustainably designed facility to "train engineers of tomorrow", Mindtree describes the detail of the structure and the philosophy behind the learning approach - including the eternal pond, the magic bricks, the LEED platinum certification expected, solar array, bio-rich gardens and more. Makes you want to be a budding Mindtree engineer. "We built Mindtree Kalinga to create complete software professionals out of campus-fresh entrants and gift them to Mindtree, to the industry and to the society."

The body of the report contains sections introduced by Mindtree execs, each sharing a personal perspective.

~~~~~~~~~~??????~~~~~~~~

Sega Sammy Group CSR Report 2016

Japan, GRI G4 (Core), ISO26000, UNGC, 10th report, 48 pages

The SEGA SAMMY Group is an entertainment company employing just over 7,000 people in businesses including pinball machines, digital games including amusement machine development and facilities, development of video content and toys and the development and operation of resorts, hotels and golf courses.

I have noticed Sega Sammy's reports for years and somehow, I never included then in the annual CSR Reporting Blog Top Ten, despite always coming close. This year, it's here. There's an authentic optimism about this report that I find very appealing.

Sega Sammy's report is quintessentially Japanese presenting all the tell-tale signs of the Japanese reporting culture: it aligns with both GRI and ISO2600 (downloadable content indices for both frameworks); it includes an external stakeholder opinion and company response; it includes a few "focus" pieces at the beginning of the report presenting key issues; texts are short paragraphs rather than long stories; it crams as much information as possible on each page using extremely small fonts; it uses charts and infographics extensively. You don't need to read this report to know it's from Tokyo.

Sega Sammy's report is structured by primary stakeholder group. with six main sections: customers, partners, shareholders and investors, employees, environment and communities. Each section opens up with a reference from the company's CSR Charter, a statement of management approach, major initiatives from the reporting period and the "voice" of an internal stakeholder.

An overview of strategic (Material) themes and broad objectives, performance in the reporting year and aspirations for the next is included. The chart notes page references for disclosures in the report, making life easier for the report reader to locate relevant content. The "voices" of team members profiled in the report are personal reflections which appear Authentic.The report is a little light on describing Impacts - this is an area for further consideration in the future.

~~~~~~~~~~~~??????~~~~~~~~

Siloso Beach Resort Sustainability Report 2015

Sentosa (Singapore), GRI G4 (Core), 4th Report, 170 pages

Located along Siloso Beach on the island of Sentosa, Siloso Beach Resort is a tranquil and rustic leisure complex. Purposely built from its conception to be an Eco Hotel and to apply best sustainable practices throughout all its operations, this privately-owned resort employs 50 - 100 people.

Siloso Beach Resort's report is one of those very personal, invested and thoughtful reports that make it fun to read about sustainability. Eco, green, nature and beauty, passion, fun, humor and some serious performance and data all come together in this charm of a report about a charm of a resort. Billed as "not a conventional report", it's not a conventional report. Yet it does conform to GRI G4 - so it's unconvention also combines with best convention in terms of reporting guidelines as well as the UN Global Compact COP requirements.

While the Authenticity of this report cannot be doubted, materiality is right up there too with a clear statement of Siloso Beach's sustainability priorities. With the flexibility typical of a privately-owned company, Siloso states that economic aspects are less important than guest and environment-related matters. They need to be "self-sustaining from a financial point of view" but social and green considerations drive the approach.

Siloso Beach presents (mostly) quantitative targets for 2014-2015 and aspirational longer term objectives and goals. All goals and targets are explained with a contextual insight and often, a local comment.

The Authenticity of this report is projected not only in the jargon-free consumer-facing language but also through the use of sustainability symbols that are part of the Resort's actual operation. Two characters walk us through our stay at Siloso Beach Resort in this report: "Prof Monitor plays the role of the knowledgeable source which we use to convey accurate key messages. Squirzy (the squirrel), on the other hand, is a more funny character which serves the purpose of asking the right questions, but sometimes in a humoristic way." A monitor lizard and a squirrel were selected as the Resort's "eco ambassador mascots" because they are often observed in the resort and represent Siloso's commitment to wildlife preservation and biodiversity. They reinforce key messages and add a touch of humor and interest to the report.

Additionally, stakeholder concerns and feedback are presented honestly and responses provided.

Siloso Beach's report is an education in eco-living and eco-management. In great detail, the company shares with us the green and glorious aspects of its operations from construction of this Resort inside a rain-forest using micro bore piling to avoid damage to trees, the rooftop vegetable farm, the live trees that continue to be protected and grow right in the guest villas, the biodiversity conservation program, energy efficient lighting, clean-tech filtration systems, solar panels, efficient heat chiller exchange systems, environmentally friendly mosquito control and more.

The report is structured in the order of GRI disclosures and each sections is labelled accordingly. However, this structure does not prevent Siloso Beach interweaving a range of creative elements to deliver a document that looks more like a magazine than a stuffy old sustainability Report. So many companies avoid using the GRI framework because they feel constrained by its requirements. This report embraces the GRI framework and make it its own. Similarly, Siloso Beach has made an earnest attempt to define its ESG impacts. As a single Resort, of course, not a sprawling multinational, the overall impacts on society and the planet are modest. Nevertheless, they are relevant and this report demonstrates an awareness and level of transparency that is a model for many small businesses.

Siloso Beach Resort, AIM model, check. PS: Congrats to Siloso Beach Resort for winning ASRA16's Best SME Report.

The Dutch-owned VanDrie Group is the world market leader in veal, founded in the early 1960s. Today, with more than 25 companies, VanDrie group is the largest integrated veal producer in the world and the global market leader in veal and the largest producer of calf milk. Approximately 1.4 million calves are processed each year, mostly for export. The VanDrie Group supplies around 28% of European demand for veal.The Group employs 2,250 employees and works with 1,100 veal farmers.

Well, I guess the vegans, vegetarians and animal rights campaigners won't like this choice. And there are possibly parts of the veal production process that even veal-eaters may prefer not to know. However, in today's world, where meat is a significant part of food demand and supply, I believe it makes sense to acknowledge meat producers who do their job responsibly, with attention to animal welfare and all other aspects of business with ethics and integrity. You may disagree. In that case, skip this report. For everyone else, or if you focus on reporting quality alone, VanDrie presents a transparent and professional story of responsible business, caring and professional attention to what matters. A materiality matrix places animal welfare way up at the top of the priority issues.

In fact, I had to laugh at myself when I reviewed this report. Number 11 issue on this list is "zoonoses". Perhaps I am showing my ignorance but I had no idea what zoonoses meant. Perhaps a disease that animals get from living in zoos? The paragraph in the report didn't totally enlighten me

Eventually, after a trip to Wikipedia, I realized that a zoonosis (zoonoses = plural) is an infectious disease in animals that can be transmitted to humans. Another reason I LOVE sustainability reports - every report teaches me something!

The VanDrie Group report reflects a pride in an job well done. Throughout the report, employees and farmers express their views, alongside interesting facts about the veal supply process.

~~~~~~~~~??????~~~~~~~

Netherlands, not GRI, 6th report, 67 pages

The Dutch-owned VanDrie Group is the world market leader in veal, founded in the early 1960s. Today, with more than 25 companies, VanDrie group is the largest integrated veal producer in the world and the global market leader in veal and the largest producer of calf milk. Approximately 1.4 million calves are processed each year, mostly for export. The VanDrie Group supplies around 28% of European demand for veal.The Group employs 2,250 employees and works with 1,100 veal farmers.

Well, I guess the vegans, vegetarians and animal rights campaigners won't like this choice. And there are possibly parts of the veal production process that even veal-eaters may prefer not to know. However, in today's world, where meat is a significant part of food demand and supply, I believe it makes sense to acknowledge meat producers who do their job responsibly, with attention to animal welfare and all other aspects of business with ethics and integrity. You may disagree. In that case, skip this report. For everyone else, or if you focus on reporting quality alone, VanDrie presents a transparent and professional story of responsible business, caring and professional attention to what matters. A materiality matrix places animal welfare way up at the top of the priority issues.

In fact, I had to laugh at myself when I reviewed this report. Number 11 issue on this list is "zoonoses". Perhaps I am showing my ignorance but I had no idea what zoonoses meant. Perhaps a disease that animals get from living in zoos? The paragraph in the report didn't totally enlighten me

Eventually, after a trip to Wikipedia, I realized that a zoonosis (zoonoses = plural) is an infectious disease in animals that can be transmitted to humans. Another reason I LOVE sustainability reports - every report teaches me something!

The VanDrie Group report reflects a pride in an job well done. Throughout the report, employees and farmers express their views, alongside interesting facts about the veal supply process.

These real people present an Authentic story. The report covers all the issues you might expect from an animal agriculture business, including antibiotics, calf health, breeding practices, food safety and more. Narrative provides context and different perspectives on important, sometimes controversial, issues. Dialogue with stakeholders is presented in detail, aligning with material issues. Data highlights are presented with effective infographics.

Chile, GRI G4 Core, UNGC, 4th Report, 100 pages

Founded in 1883, Vi�a Concha y Toro is Latin America�s leading producer, currently exporting to 147 countries worldwide. It owns around 10,800 hectares of prime vineyards in Chile, Argentina and United States. The Concha y Toro Group comprises successful brands such as Don Melchor, Almaviva, Casillero del Diablo, Trivento and Fetzer. The company has 3,450 employees and is headquartered in Santiago, Chile.

This is one of the reports that captivates you by its incredible photography and imagery, well before you start to focus on the written word. This is as much an artistic creation as a sustainability report.

However, the beautiful images do not detract from the professionalism of this report, they only add to it. They are also supplemented by aesthetic infographics throughout the report. Disclosure labels are used throughout to identify G4 responses.

The report is structured in five main sections which are pillars of Concha's sustainability strategy: People, Society, Supply Chain, Product, Customers and Environment. There are also separate mini-reports for three subsidiary vineyards. Material issues are listed in a table:

The disclosures in this report are fact-based - not much in the way of embellishments or case studies. But important issues are addressed head-on.

The detailed disclosures in this report are highly informative and demonstrate transparency. From the data relating to all processes in the supply chain to the amounts of different materials used in each stage of wine production to the number of customer audits of Concha's facilities to detailed environmental data including Scope 3 emissions to forests inventoried for biodiversity, this report ensures that all relevant information is accessible to stakeholders in a clear and careful manner. AIM. Check.

~~~~~~~~~??????~~~~~~~

United Kingdom, not GRI, 10th report, 30 pages

Morrisons is the fourth largest food retailer in the UK, founded in 1899 in Bradford, Yorkshire and currently operating 498 stores with more than 117,000 employees serving 11 million customers.

It have always liked Morrisons reporting - it has tended to be simple, plain-talking and eye-level over the years. This 2015/16 review is another strong example of getting the message through. It's focused, direct, disciplined, professional - and considerably shorter than prior years. It's not written in accordance with any particular framework - never has been - but it is externally assured and includes the key elements that I believe stakeholders need to know, for the most part. In fact, it's appeal is probably broad enough to interest consumers - the directness of the language and easy-to-follow format make this report accessible (and interesting) for any reader, not just investors or professional report-users. Just by calling themselves a "food maker and shopkeeper", Morrison's makes a more personal connection to what consumers identify with, rather than a national (or global) grocery chain that smacks of anonymity and distance. Morrisons has developed a personality in its reporting that is distinct from other major grocery retailers.

The clear message in this year's report, influenced, it seems, by the new CEO, is the strong emphasis on listening. In fact, this report is all about responding to what Morrisons has been hearing. In 2015, Morrisons performed a customer insight survey and the result was a set of priority issues for consumers.

While not a "materiality assessment" in the strictest sense of the word as it is defined for sustainability reporting, as it is determined only by consumers rather than a range of stakeholders, the list is reflective of issues that stakeholders in other categories might prioritizes - employees and environmental supporters, for example. Interestingly, while waste is seen as an issue, reducing energy and water use, or climate change, did not make the top 12 issues for consumers. However, Morrisons does report energy, carbon and waste performance against targets.

Upfront, Morrisons provides an overview of what was achieved in the reporting period and ongoing commitments across all issues, including some quantitative targets to 2020.

The report then follows a symmetrical structure of one page per issue, in a standard format: what we did in 2015/16, who we are working with, and what's next. It's short, sharp and does the job.

The report rounds off with a detailed performance summary and KPIs against all commitments and targets.

As an individual and focused review with broad consumer appeal and compact updates on performance, this report delivers the AIM model. For data-hungry professionals, who want to see charts of data and trends over multiple years and a little more depth in reporting, this report does probably not meet the need. On the other hand, many 100+ page reporters could possibly learn a thing or two from this report.

~~~~~~~~~~~??????~~~~~~~~

Kuwait, GRI G4 Core, 5th report, 134 pages

Zain is the pioneer of mobile telecommunications in the Middle East, founded in 1983 in Kuwait as the region�s first mobile operator. Today, Zain has a commercial footprint in 8 Middle Eastern and North African countries with a workforce of over 7,000 providing a comprehensive range of mobile voice and data services to over 45.8 million active individual and business customers.

This report from Zain addresses the challenges and volatile circumstances of the region head-on. "Operational context" is a significant part of this company's daily reality and sustainability focus. Messages from the Chair, the CEO and the Head of Corporate Sustainability all refer to these challenges across the 8 Middle Eastern countries that this group operates. Quoting the Head of CS, Jennifer Suleiman, "2015 was a year filled with dualities ranging from great promise to immense human tragedy and suffering. During the year, the world experienced devastating consequences from the war in Syria which impacted millions of people seeking a better life in other parts of the world. This was further compounded by the ongoing acts of terrorism and social unrest in Iraq, which precipitated the crisis and the mass migration of that symbolizes the breakdown of the essential fabric of life that binds us together ", we gain a glimpse of the daily impact of operational context.

This is only indirectly represented in the company's materiality matrix, which puts governance, ethics, economic performance and employment at the top of the ladder.

However, in the report, challenges are addressed in different sections with direct and frank narrative.

What is most appealing about the Zain report is that it presents a holistic picture of the role of the company in society and the communities it serves, almost all of which are troubled by hardship and where communications technologies can help. Whether it be refugees, war-stricken areas, infrastructure deficiencies, currency challenges, youth unemployment, empowering women and more, Zain's report presents its performance in the context of these social issues and the role that the company plays in providing services and assistance to strengthen the people and the region.

In addition, the report covers all the bases in terms of direct impacts, governance, environmental stewardship and more. This is definitely an AIM report.

~~~~~~~~~??????~~~~~~~

That completes the round up for this year. Even with 15 reports, I still feel that I have not done justice to many great reporters and reports that saw the light of day in 2016. I hope this selection provides food for thought as you move forward with your reporting. Thank you to all the Top 15 (and many other reporters) for providing me with inspiration and interest.

Wishing you all Happy Reporting in 2017!

elaine cohen, CSR consultant, Sustainability Reporter, HR Professional, Trust Across America 2017 Lifetime Achievement Award honoree, Ice Cream Addict, Author of Understanding G4: the Concise Guide to Next Generation Sustainability Reporting AND Sustainability Reporting for SMEs: Competitive Advantage Through Transparency AND CSR for HR: A necessary partnership for advancing responsible business practices . Contact me via Twitter (@elainecohen) or via my business website www.b-yond.biz (Beyond Business Ltd, an inspired CSR consulting and Sustainability Reporting firm). Need help writing your first / next Sustainability Report? Contact elaine: info@b-yond.biz

Advertisemen

#csr best practice best sustainability reports csr reporting G4 GRI sustainability reporting top reports top ten